Section 274 Entertainment Disallowance Rules

Internal Revenue Code Section 274(a) disallows a deduction for certain expenses for entertainment, amusement, or recreation activities, or for an entertainment facility (which includes an aircraft). Under Section 274, no tax deduction otherwise allowable under the Internal Revenue Code is allowed for expenses for the use of a taxpayer-provided aircraft for entertainment, amusement or recreation. The IRS' regulations provide only limited guidance on what "entertainment", "amusement" or "recreation" means for this purpose. The regulations state that the term "entertainment means any activity which is of a type generally considered to constitute entertainment, amusement, or recreation, such as entertaining at night clubs, cocktail lounges, theaters, country clubs, golf and athletic clubs, sporting events, and on hunting, fishing, vacation and similar trips, including such activity relating solely to the taxpayer or the taxpayer's family." See Treas. Reg. §1.274-2(b)(1). Travel to and from vacation locations has been treated by the IRS as entertainment. See TAM 9715001 (4/11/1997); Treas. Reg. §1.274-10(b)(2) (Entertainment air travel is any travel aboard a taxpayer-provided aircraft for entertainment purposes). The Regulations do provide that "entertainment does not include personal travel that is not for entertainment purposes. For example, travel to attend a family member's funeral is not entertainment." Treas. Reg. § 1.274-10(b)(1).

At one time, a distinction was drawn between business entertainment (that could be deducted) and personal entertainment (which could not be deducted). However, after passage of the Tax Cuts and Jobs Act in 2017, all entertainment expenses became non-deductible. Hence, use of an aircraft to travel to a business entertainment event is now non-deductible.

Methods to Compute Expense Disallowance for Entertainment Air Travel

The Regulations permit the computation of the disallowance percentages for entertainment use of an aircraft under 4 methods: Flight by flight hours, flight by flight miles, occupied seat miles and occupied set hours. See Treas. Reg. §1.274-10(e). The occupied seat hours or miles method determines the amount of expenses allocated to a particular entertainment flight of a specified individual based on the occupied seat hours or miles for an aircraft for the taxable year. The occupied seat hours or miles for a flight is the number of hours or miles flown for the flight multiplied by the number of seats occupied on that flight. For example, a flight of 6 hours with three passengers results in 18 occupied seat hours. The flight-by-flight method determines the amount of expenses allocated to a particular entertainment flight of a specified individual on a flight-by-flight basis by allocating expenses to individual flights and then to a specified individual traveling for entertainment purposes on that flight. A taxpayer must use the same method for all aircraft for the entire tax year, but a taxpayer can change to one of the other authorized methods in a subsequent year. These methods are further adjusted to provide that empty, repositioning or deadhead flights are characterized based on the flight to which they are associated. Complicated rules are provided in IRS regulations when the empty, repositioning or deadhead flight is between two occupied flights (as opposed to preceding or after a flight). See Reg. § 1.274-10. In addition, special rules also exist for multi-leg flights that have business and entertainment legs.

Required Records and Substantiation

The IRS regulations detail items that are needed to complete the business versus personal use calculation as part of the flight records:

- Date, departure and landing destinations, trip hours and miles flown

- IRC Section 274(d) substantiation for all flight legs

- Passenger manifest for every flight leg

- The business purpose, if any, of each passenger on each flight leg

- List of “specified individuals” of the company as defined in Treas. Reg. 1.274-9

- List of amounts that are treated as compensation to employees and “specified individuals” who are not employees, for example a CEO or business owner

- All direct and indirect aircraft expenses deducted on the tax return for the year under exam

- The method the taxpayer used to calculate business versus personal flight usage

Limited Continuing Exceptions

Notwithstanding the blanket prohibition against the deduction of of expenses for entertainment, amusement or recreation, Section 274(e) carves out a narrow exception. Specifically, Section 274(e) provides that except with respect to such items provided to specified individuals, the general Section 274(a) prohibition does not apply expenses for goods, services, and facilities, to the extent that the expenses are treated by the taxpayer, with respect to the recipient of the entertainment, amusement, or recreation, as compensation to an employee as wages to such employee for purposes of chapter 24 (relating to withholding of income tax at source on wages). This has been interpreted as providing a useful exception for employees and other guests which are not specified individuals provided SIFL income income is imputed and reported appropriately to the applicable employee. With repect to specified individuals, the exception only applies to the extent of the amount included in the income of the specified individual. This has the effect of eliminating any tax advantages associated with the allocable costs and expenses of the flight exceeding the imputed SIFL income amount.

Who is a Specified Individual

A specified individual is defined as any individual who is subject to the requirements of Section 16(a) of the Securities Exchange Act of 1934 with respect to a corporation or any subsidiaries as well as any individual who would be subject to the Section 16 reporting rules if the corporation (or any of its subsidiaries) were subject to these reporting rules. IRC § 274(e). This would generally include officers, directors, and 10% shareholders. In the case of a partnership, a specified individual includes any partner that holds more than a 10% equity interest in the partnership and any general partner, officer, or managing partner of the partnership.

Different Rules for Sole Proprietorships and Disregarded Entities

The four specific methods set forth by the IRS in regulations and the statutory exceptions to the entertainment disallowance rules set forth in Section 274 do not appear to be applicable to sole proprietorships and single member disregarded entities (single member LLCs). See IRS ILM 202117012. The IRS has indicated that expenses for use by a sole proprietor of an aircraft owned by the sole proprietor may be deductible as a trade or business expense based on the primary purpose test (expenses deductible only if the primary purpose of the travel is for business). The IRS has further indicated that in the case of a sole proprietorship or disregarded entity, because the general entertainment disallowance rules apply, "[a]n allocation between business use and nondeductible entertainment use of an aircraft must be made using a reasonable method when deducting expenses, including depreciation, for a flight if any person on the flight engaged in entertainment activities during the associated trip." Consequently, taxpayers may want to use (or at least track the results under) those approaches set forth in the regulations in order to make or check the reasonableness of allocations in the absence of better IRS guidance. This will particularly be the case where there is a flight that is a both a flight by the sole proprietor (with or without guests) and a flight with an employee or if family members accompany the sole proprietor. Even in the case of an aircraft owned by a sole proprietor, the provisions of Section 274(m)(3) are applicable. Section 274(m)(3) provides that "[n]o deduction shall be allowed ... for travel expenses paid or incurred with respect to a spouse, dependent, or other individual accompanying the taxpayer ... on business travel, unless— (A) the spouse, dependent, or other individual is an employee of the taxpayer, (B) the travel of the spouse, dependent, or other individual is for a bona fide business purpose, and (C) such expenses would otherwise be deductible by the spouse, dependent, or other individual." It follows that if family members accompany a sole proprietor on a business trip, some portion of the expenses of the trip should be allocable to such family members and will be non-deductible except in those circumstances where an exception to Section 274(m)(3) applies, although the matter is not free from doubt given the lack of guidance in this area.

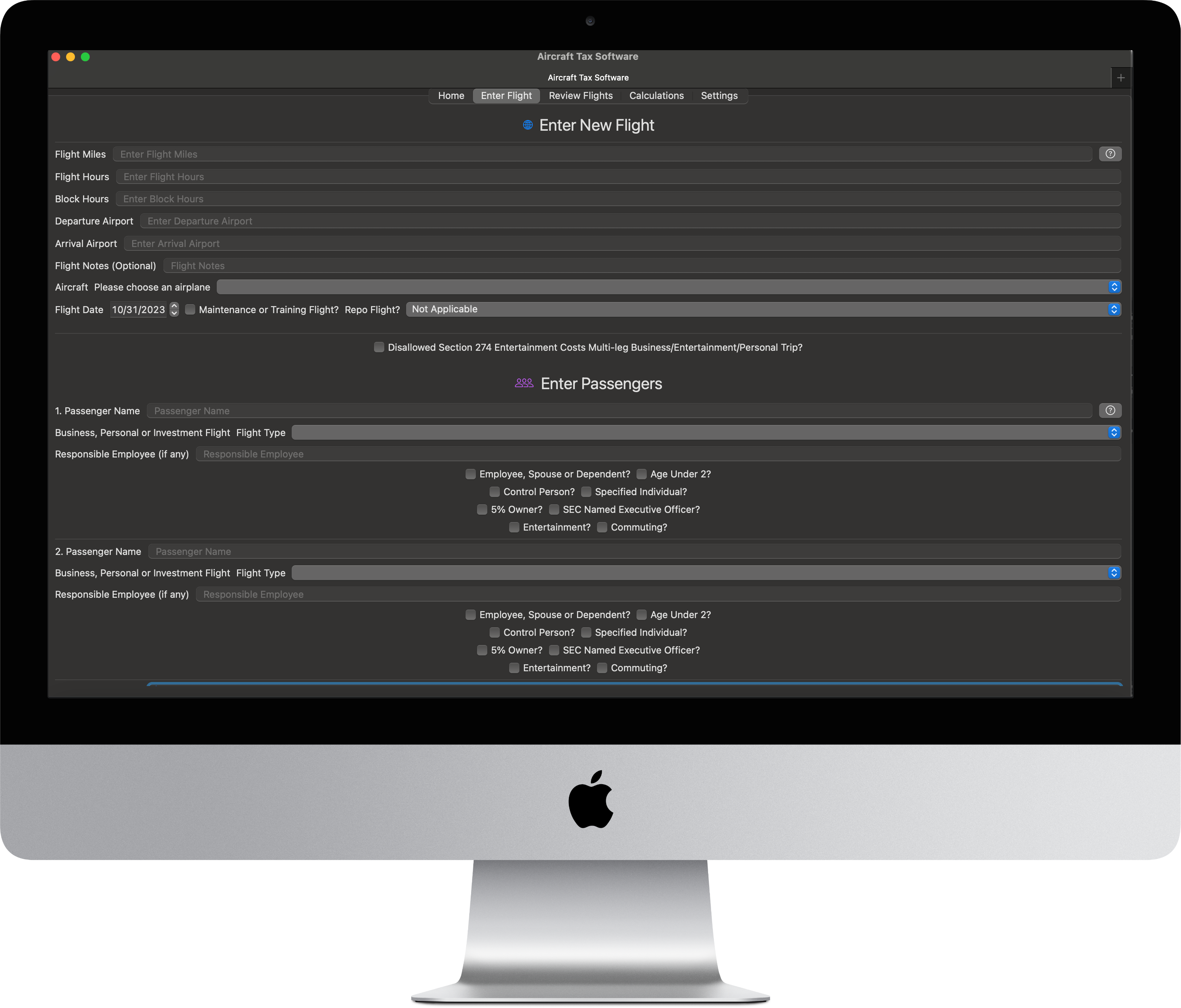

Sign Up For Free 60 Day Aircraft Tax Software Trial.

Signup for a free trial of the AircraftTaxSolutions.com Aircraft Tax Software to track personal, entertainment, commuting and business flight hours and miles to compute Internal Revenue Code Section 280F Qualified Business Use percentages, Standard industry fare level (SIFL) imputed income amounts for personal use flights, IRC Section 274 entertainment and commuting expense disallowance amounts and SEC Incremental Costs for reporting for named executive officers. Track Internal Revenue Code Section 280F Qualified Business Use percentage thresholds which must be met or exceeded in the year of purchase to obtain bonus depreciation and to use accelerated depreciation methods, and must be met or exceeded in subsequent years to avoid depreciation recapture. Multi-leg entertainment flight tracking and calculation option included. Repositioning flights tracked. Complete flight package for tax and SEC Aircraft tracking and compliance reporting. Download logs for audit purposes and records.

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription. Download on the Mac App Store , on the iOS-iPhone App Store or signup for the web version. Sixty-day free trial available (no credit card or commitment required).

* AircraftTaxSolutions.com does not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.