100% Bonus Depreciation and Section 280F

The "One Big Beautiful Bill Act" and Bonus Depreciation

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently restores 100% bonus depreciation for qualifying new and used aircraft. For aircraft owners, this can represent a massive upfront tax saving, offsetting income and significantly reducing tax liability in the year of acquisition.

However, eligibility for this powerful deduction is not automatic. To qualify for and retain this benefit, aircraft owners must navigate specific regulatory tests, most notably the "Qualified Business Use" test under Internal Revenue Code Section 280F. Failure to meet these requirements can not only disqualify an owner from taking bonus depreciation in the first year but can also trigger expensive "recapture" of depreciation in subsequent years.

The Critical Role of Section 280F Qualified Business Use

Internal Revenue Code Section 280F imposes strict limitations on depreciation deductions for "listed property," a category that includes passenger automobiles and other property used for transportation, such as aircraft.

To be eligible for MACRS depreciation (including 100% bonus depreciation), the aircraft must be predominantly used in a "qualified business use" for any taxable year. This generally means that the "qualified business use" of the aircraft must exceed 50% of its total use.

Distinctions Between Entity Owned Aircraft and Direct Sole Proprietorship Owned Aircraft

The rules under Section 280F are different depending on whether the taxpayer directly owns the aircraft (including ownership through 100% owned disregarded entities (single member limited liability company, titling trust, etc...)) as a sole proprietor or whether an employer entity (such as a C-Corporation, S-Corporation or Partnership) owns the aircraft (in which case the special rules for employer provided aircraft described above apply).

Employer Provided Aircraft Structure (Entity Owned): Under this structure, the company owns the aircraft and uses it to transport its executives. Personal flights are reported as compensation (usually at SIFL rates). A "Two-Step" test generally applies. First, the 25% qualified business use test is applied. For this test, flights provided as compensation to 5% owners are excluded from qualified business use. If the aircraft passes this 25% test (i.e. at least 25% of use is qualified business use without counting the owner's personal/compensation flights), then the 50% qualified business use test is applied. Crucially, for the 50% test, the flights provided as compensation to 5% owners are included as qualified business use (because providing compensation is a business purpose). This structure often allows an aircraft to pass the 50% test even with significant personal use by the owner, provided the 25% threshold of non-owner business use is met.

Sole Proprietorship Structure (Direct Ownership): Under this structure, the aircraft is owned by an individual (or their disregarded entity) and used in their business. A sole proprietor cannot provide "compensation" to themselves. Therefore, the "Compensation Exceptions" do not apply to the owner's travel. Consequently, the 25% test (which relies on excluding compensation flights) is generally irrelevant or identical to the 50% test. The 50% qualified business use test is applied directly based on the actual purpose of each flight. If the owner flies for personal reasons (vacation, entertainment), those flights are personal use. They cannot be converted to business use by "imputing income" because one cannot impute income to oneself. This makes it harder for sole proprietorships to meet the 50% test if there is significant personal use by the owner.

If the Qualified Business Use does not exceed 50% of total use:

- Year of Purchase: You are ineligible for bonus depreciation and accelerated MACRS depreciation. You must instead use the slower Alternative Depreciation System (ADS), which requires straight-line depreciation over a longer recovery period.

- Subsequent Years (Recapture): If you claim bonus depreciation in year 1 but fail the 50% Qualified Business Use test in a later year (e.g., year 2 or 3), you must "recapture" the excess depreciation. This means you have to pay back the tax benefit you received earlier, reporting the difference between the depreciation taken and what would have been allowed under ADS as ordinary income.

Importance of Monitoring Each Passenger's Purpose for Section 280F Calculations

To accurately perform the Section 280F calculations, especially for sole proprietorships or for flights with mixed groups of passengers (e.g., business colleagues and family members), it is critical to monitor and record the specific purpose of travel for each passenger on the aircraft. Broadly classifying a flight as "Business" or "Personal" is often insufficient. You must track whether each passenger is traveling for:

- Business: Traveling for the trade or business of the taxpayer.

- Personal (Non-Entertainment): Personal travel that is not entertainment (e.g., attending a funeral, medical appointment, or commuting).

- Personal (Entertainment): Travel for recreation, amusement, or social purposes.

- For the 25% Test (Entity Owned), you must exclude flights by 5% owners and related parties, while potentially including flights by non-owners.

- For Sole Proprietorships, or when using the "Occupied Seat" or "Flight-by-Flight" allocation methods, the percentage of business use is calculated based on the ratio of business passengers to total passengers (or business seat-miles to total seat-miles).

- Entertainment use may be treated differently or disallowed under Section 274, and distinct tracking ensures these flights are handled correctly in the calculations.

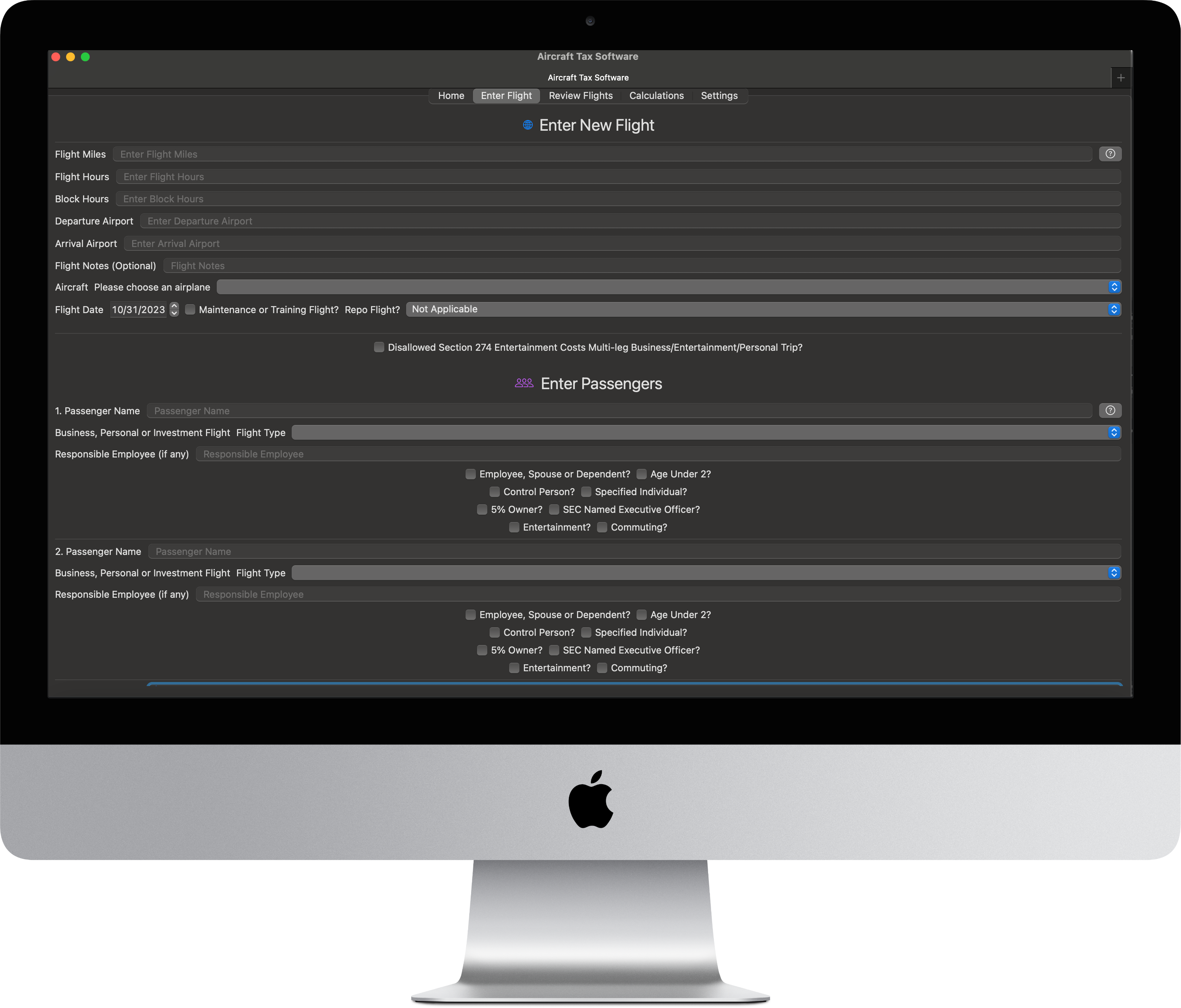

Simplify Your Aircraft Tax Compliance

Don't rely on inadequate records or error prone spreadsheets. Use the Aircraft Tax Software App to track SIFL income and personal, entertainment, commuting and business flight hours and miles.

Sign up for a free 60-day trial and start tracking today.

Sign Up For Free 60 Day Aircraft Tax Software Trial.

Sign up for a 60-day free trial of the AircraftTaxSolutions.com Aircraft Tax Software to track personal, entertainment, commuting and business flight hours and miles to compute Internal Revenue Code Section 280F Qualified Business Use percentages, Standard industry fare level (SIFL) imputed income amounts for personal use flights, IRC Section 274 entertainment and commuting expense disallowance amounts and SEC Incremental Costs for reporting for named executive officers. Track Internal Revenue Code Section 280F Qualified Business Use percentage thresholds which must be met or exceeded in the year of purchase to obtain bonus depreciation and to use accelerated depreciation methods, and must be met or exceeded in subsequent years to avoid depreciation recapture. Multi-leg entertainment flight tracking and calculation option included. Repositioning flights tracked. Complete flight package for tax and SEC Aircraft tracking and compliance reporting. Download logs for audit purposes and records. No credit card or commitment needed for 60-day free trial. Request a software demo as well.

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription. Download on the Mac App Store , on the iOS-iPhone App Store or signup for the web version. Sixty-day free trial available (no credit card or commitment required).

* AircraftTaxSolutions.com does not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and are not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.